pa auto sales tax

Pennsylvania has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 2. 1 percent for Allegheny County 2 percent for Philadelphia.

Virginia Sales Tax On Cars Everything You Need To Know

2022 List of Pennsylvania Local Sales Tax Rates.

. When Pennsylvania sales tax is not charged by the seller on a taxable item or service delivered into or used in Pennsylvania the consumer is required by law to report and remit use tax to the Department of Revenue. The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. Effective October 30 2017 a prorated partial day fee for carsharing services was provided as a clarification to the current vehicle rental fee.

Start filing your tax return now. Payment can be made online when completing a PA-1 Use Tax Return. Our free online Pennsylvania sales tax calculator calculates exact sales tax by state county city or ZIP code.

At PA Auto Sales we finance everyone. BuyingSelling Your Vehicle in PA pg. Less than 2 hours.

Bethel Park PA Sales Tax Rate. Motor vehicle sales tax is paid directly to the Department of Transportation which acts. PA has a 6 sales tax rate for motor vehicles.

The following is what you will need to use TeleFile for salesuse tax. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax. Nine-digit Federal Employer Identification Number or Social Security number or your 10-digit Revenue ID.

The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. Any vehicle thats designed to be used on the highway whether its a sedan boat trailer camper or even a mobile home is subject to sales tax because it is personal property. VIN verification is required for out of state vehicles.

Many taxpayers are unaware that sales tax due to the Department of Revenue is a percentage of the fair market value of a vehicle rather than a. STATE OR LOCAL SALES AND USE TAX STATE OR LOCAL HOTEL OCCUPANCY TAX PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA PASSENGER CAR RENTAL TAX. Some examples of items that exempt from Pennsylvania sales tax are food not ready to eat food most types of clothing textbooks gum candy heating fuels intended for residential property or.

Shop All Locations 360 Philadelphia 216 Warrington 139 Vehicles 360. See Malt Beverage Tax Rate Table. The latest sales tax rates for cities in Pennsylvania PA state.

In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer. If the vehicle is being given as a gift the Form MV-13ST PDF Affidavit of Gift must be attached to the title application. Source The provisions of this 3148 adopted September 29 1972 effective September 30 1972 2 PaB.

Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny County and a 2 percent local sales tax for vehicles registered in Philadelphia. There are a total of 68 local tax jurisdictions across the state.

The fee schedule is as follows. 260 per pack of 20 cigaretteslittle cigars 013 per stick Malt Beverage Tax. For instance if your new car costs you 25000 you can expect to pay an additional 1500 in state sales tax alone.

Well get you in the perfect car truck or SUV for your lifestyle. Some dealerships may also charge a 113 dollar document preparation charge. You can find these fees further down on the.

Rates include state county and city taxes. 2020 rates included for use while preparing your income tax deduction. So you would pay 43 annually for registration renewal.

BUREAU OF DESK REVIEW AND ANALYSIS. According to the. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166 on.

A tracing is obtained by placing tracing paper against the VIN plate and applying pressure with a lead. This form must be completed by all transferees and transferors and attached to Form MV-1 or MV-4ST for any transfer for which a gift exemption Exemption 13 for purposes of Pennsylvania Sales and Use. To verify your Entity Identification Number contact the e-Business Center at 717-783-6277.

If the vehicle will be registered in Allegheny County PAs 2 nd most populous county theres an added 1 local sales tax for a total of 7 sales tax on a vehicle purchase. Average Sales Tax With Local. Begin Main Content Area.

The car dealer will follow the sales tax collection laws of their own state. PA DEPARTMENT OF REVENUE. Back Mountain PA Sales Tax Rate.

The purchase of a vehicle by the person who will transfer it to the winner is subject to tax. Use tax is the counterpart of the state and local sales taxes. Welcome to PA Auto Sales We are transforming the means by which you can buy used cars in the USA.

That way you dont have to deal with the fuss of trying to follow each states. 35 Easton Rd Warrington PA 18976 11600 Roosevelt Blvd Philadelphia PA 19116. Lowest sales tax 6 Highest sales tax 8 Pennsylvania Sales Tax.

Allentown PA Sales Tax Rate. TAX DAY NOW MAY 17th - There are -373 days left until taxes are due. Try our FREE income tax calculator.

Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency. Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. In addition to taxes car purchases in Pennsylvania may be subject to other fees like registration title and plate fees.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. DMV Vehicle Services Vehicle Information Selling a Vehicle in PA. Harrisburg PA 17106-8597 unless the seller is planning to transfer the plate to another vehicle.

For example a regular passenger vehicle registered in Philadelphia PA will have a 38 renewal fee plus the 5 local fee. 6 percent state. We are proud to offer our large inventory of used vehicles to our.

PA Sales Use and Hotel Occupancy Tax. 2 to 3 hours. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8.

Thanks to our one-of-a-kind service both current and potential car owners can find the vehicle of their choice in a safe secure and hassle-free buying process by using our site. The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. 280901 HARRISBURG PA 17128-0901 Read Instructions On Reverse Carefully PENNSYLVANIA EXEMPTION CERTIFICATE CHECK ONE.

Eight-digit Sales Tax Account ID Number. BUREAU OF BUSINESS TRUST FUND TAXES DEPT. Altoona PA Sales Tax Rate.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The use tax rate is the same as the sales tax rate. In Philadelphia theres an extra 2 sales tax for registering a car for a whopping 8 total.

Nj Car Sales Tax Everything You Need To Know

What Is Pennsylvania Pa Sales Tax On Cars

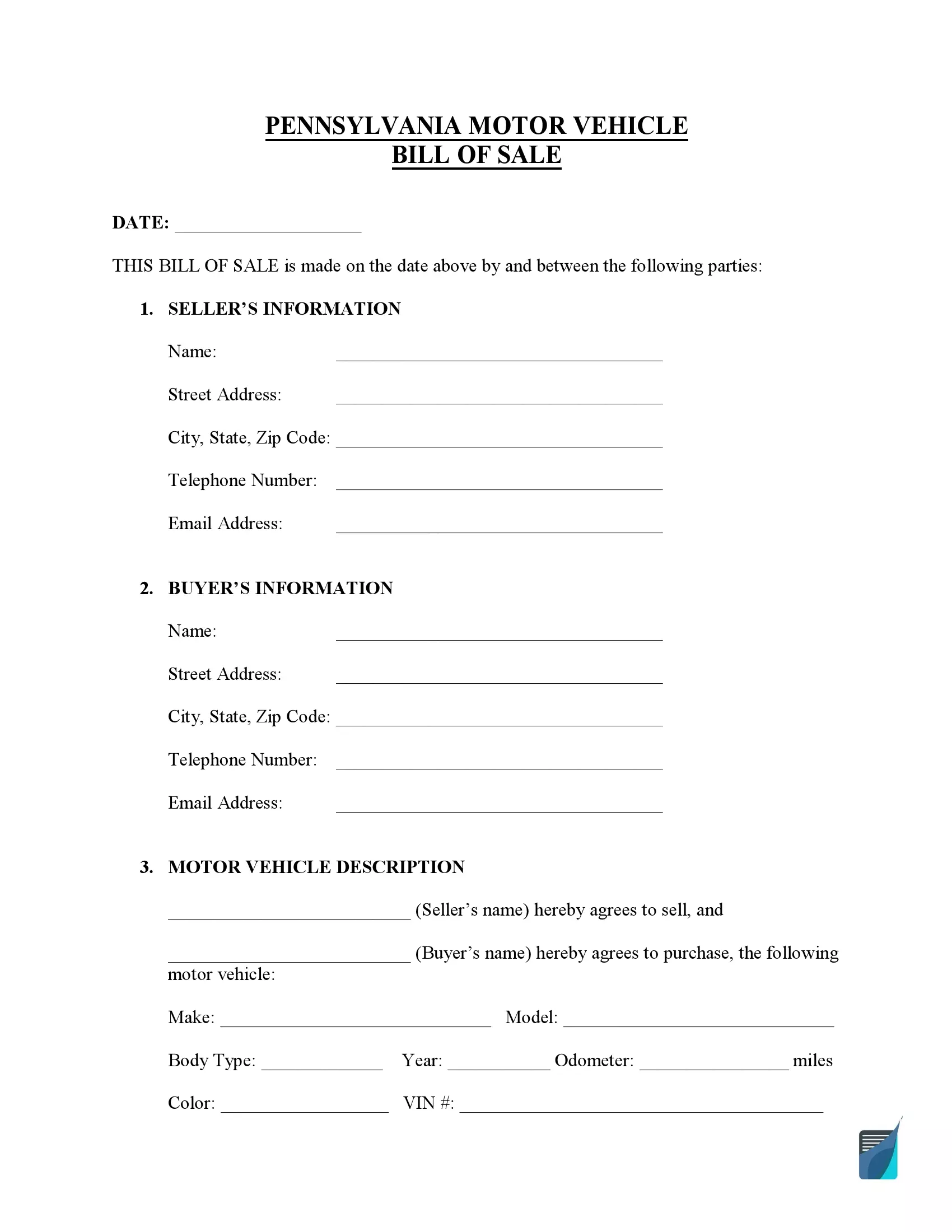

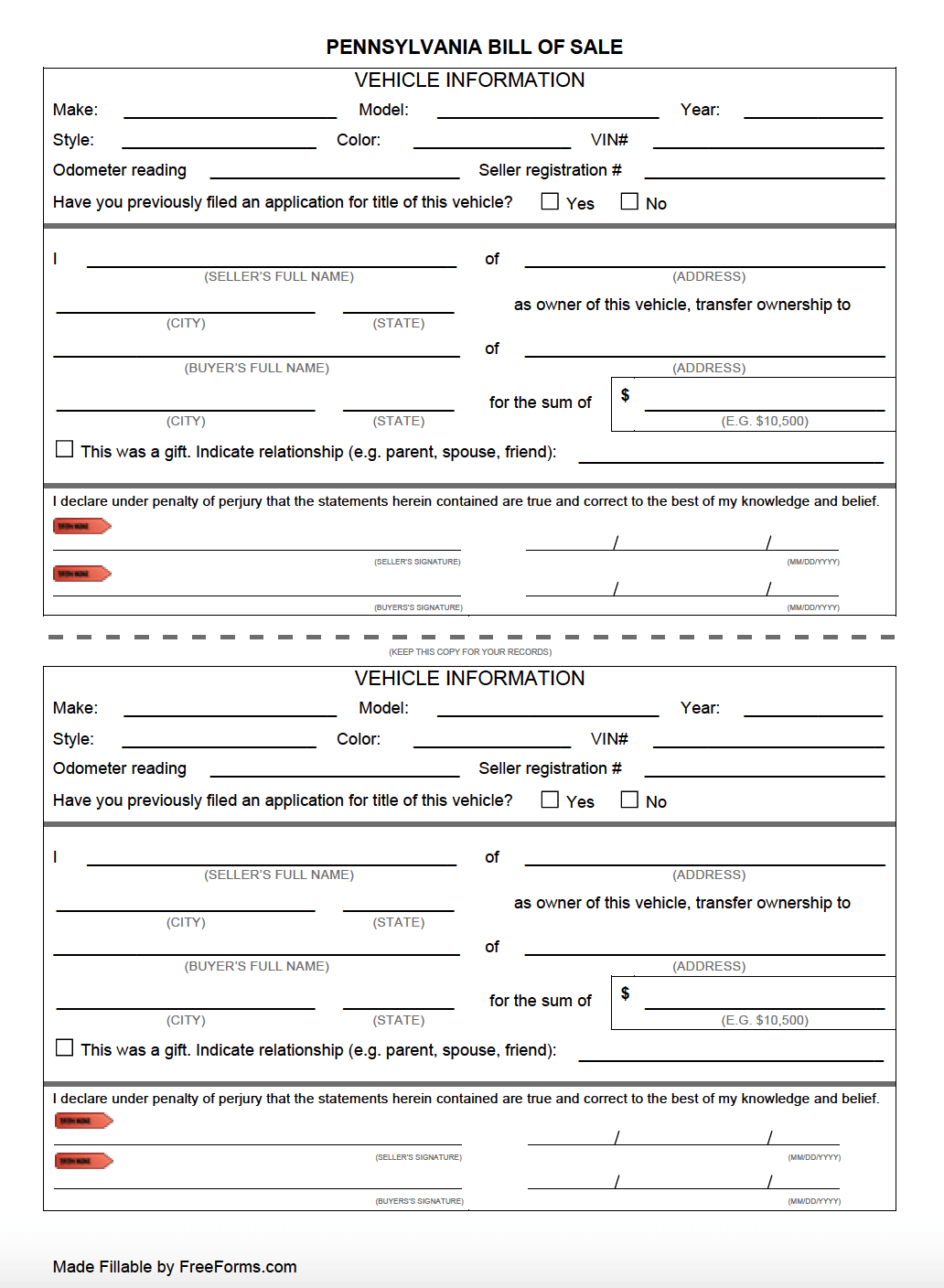

Free Pennsylvania Vehicle Bill Of Sale Form Pdf Formspal

Form Mv 4st Vehicle Sales And Use Tax Return Application For Registration Templateroller

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

Is It Better To Buy A Car In Nj Or Pa Njstateauto Used Cars Blog

2018 Dodge Durango R T V 8 Check More At Http Www Autocarblog Club 2018 06 02 2018 Dodge Durango R T V 8

Car Sales Tax In Delaware Getjerry Com

Free Pennsylvania Bill Of Sale Forms Pdf

Pennsylvania Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax On Cars And Vehicles In Pennsylvania

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

Ilan S Auto Sales Glenside Pa Cars Com

Free Pennsylvania Bill Of Sale Form Pdf Word Legaltemplates

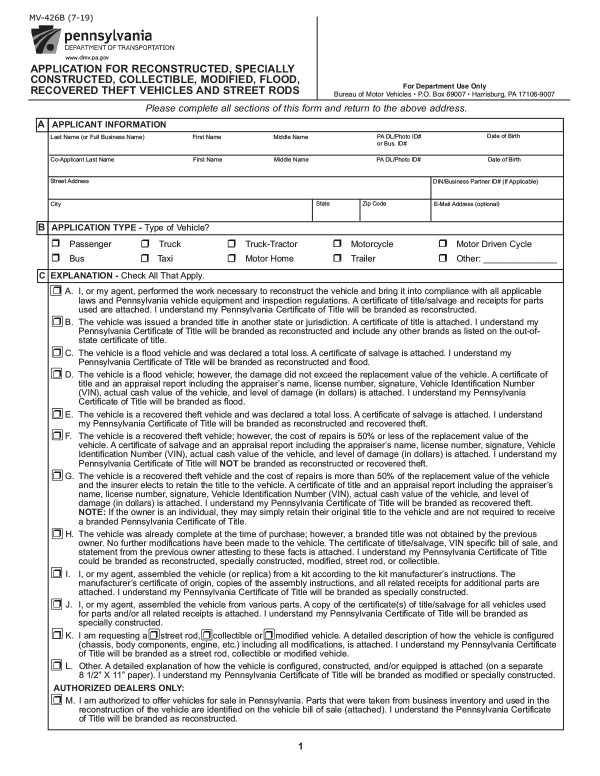

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Fixed Price Vehicle Sales Department Of General Services Commonwealth Of Pennsylvania